From London to Pretoria, finance ministers around the world are struggling to pass painful budgets in the face of political opposition. The Organisation for Economic Cooperation and Development has a plan.

The Paris-based group is developing a fiscal literacy “masterclass” aimed at getting lawmakers fully briefed on the strains facing their public finances. The proposal has already attracted interest from a number of parliaments, according to officials.

Read: Jeremy’s weekly wrap: Budget battles, tariff shock and Gautrain’s future

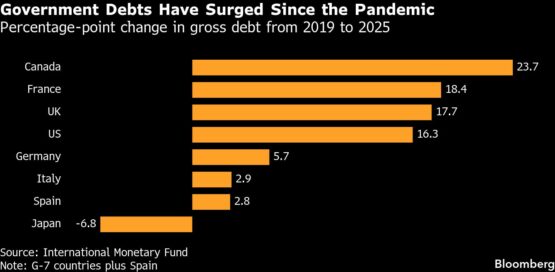

Budget deadlock triggered several global crises last year, as political leaders trying to rein in spending and deficits collided with hard-pressed electorates newly tempted by populist parties.

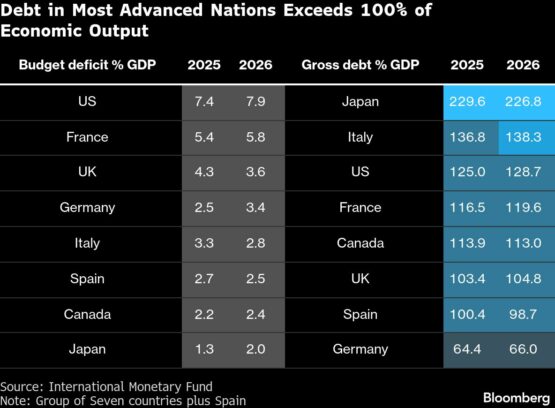

Fiscal missteps are all the more dangerous at a time when economic growth for many is sluggish and unsustainable public debts exceeding 100% of GDP in most advanced industrial nations can quickly make them a target for bond vigilantes.

ADVERTISEMENT

CONTINUE READING BELOW

Read: Budget 2026: Will Sars be able to avert tax increases?

“There’s a strong need for restoring public finances across a lot of OECD countries with historically high debt levels,” Scherie Nicol, senior policy analyst at the OECD, told Bloomberg. “But it’s very difficult for OECD countries to actually succeed in designing, approving and implementing budget reforms.”

Read: Rand weakens amid budget turmoil and Trump’s ‘Liberation Day’

Among countries showing interest is Scotland. With the encouragement of the OECD, the devolved legislature in Edinburgh plans to launch its own financial-literacy training program this autumn to educate the new crop of lawmakers after elections in May.

Kenneth Gibson, head of the Scottish Parliament’s Finance and Public Administration Committee, said a better understanding of the fiscal situation would improve the quality of debate, smoke out “snake-oil salesmen” who deliberately mislead the public and improve political decision making. “It will be harder to pull the wool over people’s eyes,” he told Bloomberg.

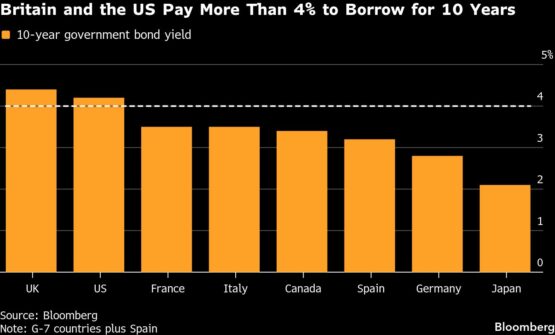

Across large swaths of the OECD, populists have either won power or are advancing. Meanwhile, bond investors ready to punish any hint of fiscal laxity have driven up borrowing costs, leaving governments less money for public services and investment.

ADVERTISEMENT:

CONTINUE READING BELOW

Read: Budget 2025: No household can just increase its income, so why can the state?

In the UK, the Labour government has been forced into multiple costly U-turns, including over cuts to welfare and winter fuel subsidies. In France, disagreements over budgets in a hung parliament have toppled prime ministers and negotiations for a delayed 2026 finance plan are dragging on. And the US had its longest ever government shutdown after a funding dispute. Spain and South Africa too have struggled to get budgets through.

The benchmark 10-year yield in the UK remains above 4%, after spiking last July in the wake of the welfare reversals — an episode with eerie echoes of the 2022 bond market meltdown that cost then-Prime Minister Liz Truss her job. The equivalent US rate is barely lower. France meanwhile has among the highest yields in the euro area, having had its credit rating downgraded by S&P Global and Fitch among others amid the budget impasse.

The OECD program will inform lawmakers on topics such as potential public debt paths, guardrails such as fiscal rules, the trade-offs facing finance ministers and how economic decisions affect voters. Nicol said it wants to run a pilot in 2026 and deliver annual masterclasses open to lawmakers across its 38 member states.

Read: Budget 2025: ‘There’s no agreement yet’ – Steenhuisen

ADVERTISEMENT:

CONTINUE READING BELOW

Scotland is already committed to introducing a financial literacy program after the summer. The May elections could see as many as half of the current 129 members of the Scottish Parliament replaced, with 42 already planning to retire, according to Gibson. Government institutions, think tanks and former lawmakers are signed up to deliver the two- or three-day program, which will potentially require annual refresher courses, though the exact structure has yet to be determined.

Gibson highlighted the urgent need to improve the public debate given UK debt has soared to £2.9 trillion ($3.9 trillion), bloated by the huge cost of getting the economy through the Covid-19 pandemic. Financial “complexity has increased significantly,” he said, adding that one colleague has even proposed lawmakers sit an exam at the end of the course.

Read: SA’s cabinet has given Godongwana options for budget

“It feels like many members speak about financial markets without looking beneath the surface,” Gibson said. “They call for more spending and lower taxes and have no real comprehension of what that means. Some people will be posturing but some really think that 2+2=5.”

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Politicians #dont #markets #receive #lesson