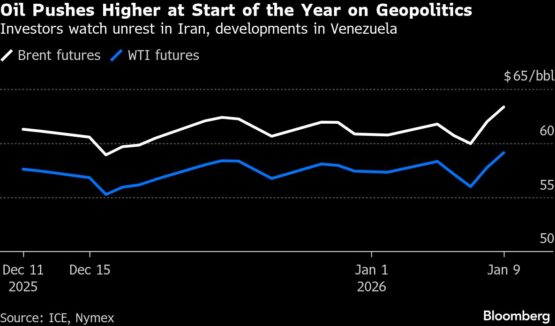

Oil held its biggest two-day gain since October, as escalating protests in Iran threatened supply from Opec’s fourth-biggest producer.

Brent traded above $63 a barrel after jumping almost 6% over Thursday and Friday, while West Texas Intermediate was near $59. President Donald Trump said that the US is closely monitoring the protests in Iran and is mulling potential options as the Islamic Republic faces its third week of nationwide protests, the largest since 2022.

Read:

Gold hits record high with focus on Fed independence and Iran

Trump’s Venezuelan move ‘poses a challenge for Opec’

“We’re looking at it very seriously. The military is looking at it, and we’re looking at some very strong options,” Trump told reporters Sunday. “We’ll make a determination.” He also touted a meeting with Tehran.

The possibility of a disruption to Iran’s daily exports of almost 2 million barrels has tempered concerns over a global glut that caused a slump in prices and made investors increasingly bearish. The scale of risk has shown up clearest in options markets, where the skew toward bullish calls is the biggest for US crude futures since July.

ADVERTISEMENT

CONTINUE READING BELOW

The unrest is the most significant challenge to Supreme Leader Ayatollah Ali Khamenei since a nationwide uprising in 2022. It follows a surge in oil prices during a 12-day war between Iran and Israel in June, which quickly eased after the US intervened and brokered a peace deal.

The Iranian turmoil has also shifted the focus away from Venezuela. Trump on Saturday signed an executive order to safeguard the Latin American country’s oil revenue held in US Treasury accounts from the nation’s creditors, but broader political uncertainty could still suppress much-needed investment.

Unless the Iranian protest “actually disrupts exports or shipping, the market will mostly fade it,” said Haris Khurshid, chief investment officer at Karobaar Capital LP in Chicago. Nevertheless, “the bar for a volatility spike is low,” he said.

Brent’s second-month volatility spiked to its highest since June on Monday while the prompt spread — the price difference between the two nearest contracts — widened in a bullish backwardation structure from a week ago.

ADVERTISEMENT:

CONTINUE READING BELOW

Trump on Friday summoned leaders of majors including Chevron Corp, Exxon Mobil Corp, and ConocoPhillips to a summit at the White House to discuss Venezuela. There, the president pledged $100 billion of the companies’ capital toward rebuilding the OPEC member’s oil sector, even as executives expressed caution, and Exxon’s head called the nation “uninvestable.”

Adding to the geopolitical tensions, Trump said the US is “going to have Greenland.” That has spurred a flurry of diplomatic activity as officials try to decipher his intentions for the self-governing territory of NATO member Denmark.

Meanwhile, Ukraine targeted three drilling platforms in the Caspian Sea owned by Russian oil major Lukoil in the latest move to weaken Moscow’s access to funds to fuel the almost four-year-old war.

| Prices: |

|---|

|

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Oil #holds #gain #Iranian #protests #raise #specter #disruption