The dollar declined the most in almost three weeks as the Federal Reserve faced grand jury subpoenas from the Justice Department, reviving concerns over political interference in monetary policy.

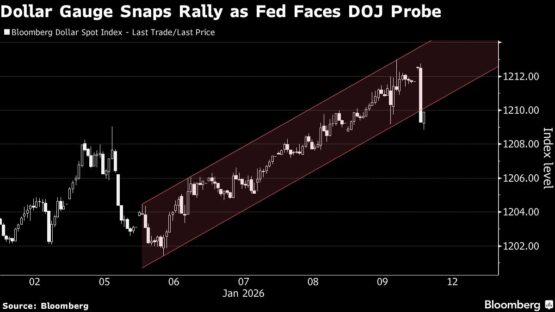

The Bloomberg Dollar Spot Index fell 0.2% in Asian trading on Monday, the biggest drop since December 23. That’s after Fed Chair Jerome Powell revealed the central bank had been served grand jury subpoenas from the Justice Department threatening a criminal indictment tied to his June testimony on headquarter renovations.

Powell said the threat of criminal charges stemmed from the central bank setting interest rates based on its own assessment rather than following preferences of President Donald Trump. Trump has repeatedly slammed Powell on social media, urging rate cuts and at one point threatening to fire him — before later backing off and denying he ever considered it.

ADVERTISEMENT

CONTINUE READING BELOW

“Trump seems adamant to exert control over the Federal Reserve, potentially undermining the Fed’s monetary policy independence,” said Fiona Lim, a senior FX strategist at Malayan Banking Bhd in Singapore. “Trump’s impatience and resolve to get borrowing costs lower suggests that his pick for the next chair could be a dove and a loyalist and that could be a risk to the greenback.”

The escalating tension is fueling market anxiety over the central bank’s autonomy. US equity futures fell while Treasury futures edged higher on Monday.

What Bloomberg strategists say:

ADVERTISEMENT:

CONTINUE READING BELOW

“Macro traders are set to lean into US dollar shorts amid the risk that Powell is hampered in fulfilling his role as Fed chair.”

Mark Cranfield, Markets Live Strategist.

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Dollar #drops #weeks #Fed #subpoenas