Donald Trump’s brazen move to snatch Nicolás Maduro from his Caracas home last week also sent a clear message to Chinese President Xi Jinping: The Western Hemisphere has no room for another superpower.

The US military’s raid on Venezuela — home to the world’s largest oil reserves and the only country in Latin America that boasts an “all-weather strategic partnership” with Beijing — marked an audacious debut of what Trump has called the “Donroe Doctrine,” a revival of the 19th-century policy by then President James Monroe establishing US dominance in the Americas.

Codified in the White House’s National Security Strategy released last month, the plan asserts a unilateral US right to deny rival powers the ability to own or control “strategically vital assets.” One particularly bold line declares that the US “should make every effort to push out foreign companies that build infrastructure in the region.”

US officials have made similarly broad statements in the wake of Maduro’s ouster. Secretary of State Marco Rubio declared the White House won’t “allow the Western Hemisphere to be a base of operation for adversaries, competitors, and rivals.” Mike Waltz, the US envoy to the United Nations, was more blunt in calling out Beijing: “The Chinese are moving incredibly aggressively into the Western Hemisphere, into South America,” he told Fox News. “President Trump and Secretary Rubio are pushing back on that hard.”

Beyond the tough talk, however, it’s unclear how exactly the Trump administration will pull that off. ABC reported on Tuesday that the White House demanded that Venezuela reduce its relationships with China, Russia, Iran and Cuba, including by severing economic ties. Yet replicating such demands across a large and politically diverse region would prove far more difficult and cause a significant uproar.

“The United States is reacting 20 years too late,” said Enrique Dussel Peters, head of the Mexico-China Studies Center of the National Autonomous University of Mexico, noting that China’s deeply integrated supply chains throughout the region would be difficult to unwind even in places that have close trade links with the US. “For practically the entire 21st century, China has had the upper hand in economic matters in Latin America.”

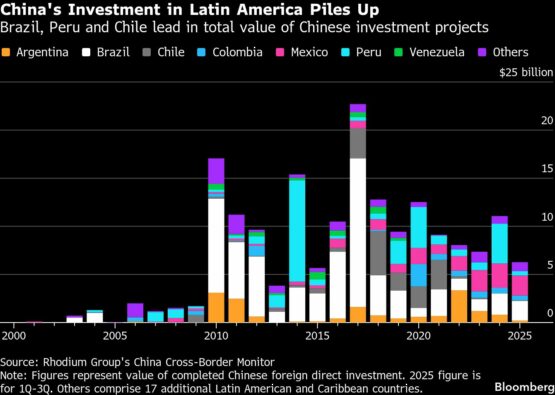

China’s goods trade with Latin America has surged since the turn of the century, rising by more than 40 times in that span to $518 billion in 2024 — challenging the US’s long-established economic dominance in the region. Increasingly, the region’s residents are driving BYD cars, using Xiaomi smartphones and ordering taxis and food from Didi instead of Uber.

A BYD factory under construction in Camacari, Brazil in January 2025. Photographer: Tuane Fernandes/Bloomberg

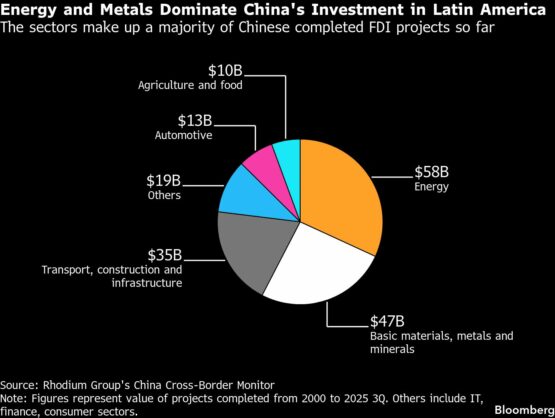

China has also invested significantly into Latin America, with direct foreign investment projects topping $180 billion by the third quarter of 2025, according to data from US-based research group Rhodium Group. China’s economic influence has surpassed that of the US in 14 of the region’s 33 countries since the turn of the century, research from Bloomberg Economics shows. In that time it has also seen several governments switch diplomatic recognition away from Taiwan to Beijing, including Honduras and Nicaragua.

For now, governments throughout the region appear dismissive of the White House threats, not least because they don’t see an inward-looking US providing an alternative to Chinese investments in the region. In Brazil, Latin America’s largest economy, officials who deal with Chinese investments saw Trump’s actions as isolated to Venezuela. Asking not to be identified to discuss government policy, the officials said President Luiz Inacio Lula da Silva won’t take sides between the US and China, and Brazil more broadly saw its diversified trade relationships as providing leverage in talks with the Trump administration.

ADVERTISEMENT

CONTINUE READING BELOW

Those sentiments were shared throughout the region’s major economies by officials who requested anonymity to speak frankly. In Mexico, a leading senator involved in trade negotiations with the US said the Venezuela move changes nothing about its approach to China. That sentiment was echoed by a diplomat in Argentina, where President Javier Milei’s government has pursued good relations with Beijing while limiting engagement in any sensitive military or political areas. Peruvian officials have stressed that growing economic links with China don’t come at the expense of longstanding defense cooperation with the US.

In Colombia, where Trump has warned Gustavo Petro — the nation’s first left-wing president — to “watch his ass,” the US has already threatened multilateral financing for projects involving Chinese companies after his government formally joined Xi’s Belt and Road Initiative. Mauricio Jaramillo, Colombia’s deputy foreign minister, called Trump’s threats unacceptable and added that the country needs to defend its sovereignty and right to pursue an independent foreign policy.

“We need to stop demonizing ties with China and separate that relationship from the relationship with the US,” Jaramillo said in an interview. “Because both countries are friends.”

For now, it’s an open question how far Trump will go to uproot Chinese influence from Latin America. Any concrete moves to implement the National Security Strategy — something Trump’s team has repeatedly said is guiding its decisions — threaten to sow fresh chaos across the region and open up new potential flashpoints with China.

While so far there’s no sign the broader US-China trade truce is under threat, with Trump and Xi set to meet four times this year, Beijing appeared stunned by Maduro’s ouster and has vowed to protect its interests in the region. On Wednesday, Foreign Ministry spokeswoman Mao Ning blasted reports that the US would pressure Venezuela to cut economic ties with China, calling it a “typical bullying act.”

“Let me stress that China and other countries have legitimate rights in Venezuela, which must be protected,” she said.

Concern over China’s access to resources was part of Trump’s calculation while authorizing the Maduro raid, according to a White House official who asked not to be identified, adding that the president was focused on ensuring dominance in the Western Hemisphere. Still, the official cautioned that other factors — including illegal drugs and migration — were the main driving forces behind the president’s decision.

“As President Trump outlined in his National Security Strategy, the administration is reasserting and enforcing the Monroe Doctrine to restore American preeminence in the Western Hemisphere, control migration, and stop drug trafficking,” White House spokesperson Anna Kelly said in response to questions. “The president has many options at his disposal to continue to protect our homeland from illicit narcotics that kill tens of thousands of Americans every year.”

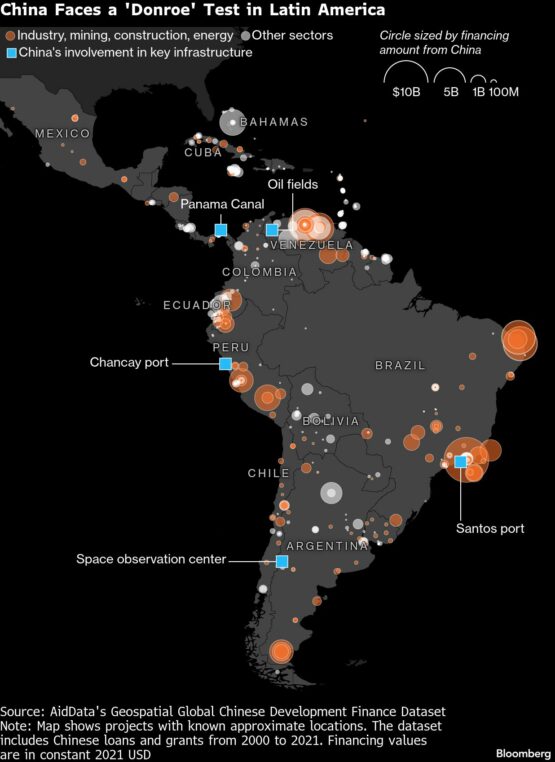

From the Panama Canal and a deep-water port in Peru to the lithium salt flats of the Andes and Venezuela’s oil fields, Chinese companies have also become embedded into strategic industries all along America’s doorstep. Many are extracting or shipping key commodities, such as oil, soybeans and critical minerals like copper and lithium, while also making investments in key infrastructure including Brazil’s electricity transmission system.

Chancay port in Peru. Photographer: Alessandro Cinque/Bloomberg

ADVERTISEMENT:

CONTINUE READING BELOW

Just how Trump could muscle China out of key infrastructure in the region remains unclear, though Argentina may offer a blueprint. The leading exporter of soy meal and oil in December blocked a Chinese bid for a 30-year contract to deepen its main waterway to ship crops to the rest of the world. It also blocked projects to build a Chinese space telescope in San Juan and a nuclear power plant in Buenos Aires. Trump has rewarded Milei with a $20 billion currency swap that helped lock in an October midterm election.

Either way, officials within China are now discussing ways to protect overseas investments.

Wu Xinbo, director at Fudan University’s Center for American Studies in Shanghai who has advised China’s government, said Beijing needs to provide sufficient deterrence to both terrorists and nations like the US that may want to target Chinese interests. Any moves by the Trump administration to target Chinese investments in the region threatens to affect the broader relationship and would prompt Beijing to retaliate, he added.

“If the US put some of our business as hostage, the target, we can do the same,” Wu added. “The US has economic interests globally, including in China.”

Xi last year leveraged China’s control of rare earths to force Trump to back down from tariffs of more than 100% on Chinese goods, leading to a truce between the two leaders cemented during a meeting between them in late October. Separately, Beijing managed to successfully push back on a deal that would see a Hong Kong conglomerate lose control of key ports in the Panama Canal and elsewhere, with state-run China Cosco Shipping Corp. set to join the buying consortium.

Yet Trump’s new push to dominate South America may lead to more forceful measures. Hours before the US raid, a high-level Chinese delegation met in Caracas with Maduro, who shared images of the group shaking hands on his Instagram page — showing the extent to which Beijing was caught off guard.

One place on the White House’s radar is the deepwater port of Chancay in Peru. Inaugurated by Xi in late 2024, the $1.3 billion megaport represented the bridgehead of a new maritime Silk Road that would drastically reduce shipping times to China. It features 17.8-meter (58-foot) deepwater berths capable of handling the world’s largest container ships and naval vessels — sparking concern it could one day serve as a Chinese military outpost, an allegation Beijing denies.

After Trump’s election win in 2024, Mauricio Claver-Carone, an adviser to his transition team, proposed a 60% tariff on any goods passing through Chinese-owned or controlled ports in the region, regardless of their country of origin. At the time, he said the goal was to make Latin American nations think twice before allowing Beijing to build a port in their territory.

In an annual report on China’s military released last month, the Pentagon also warned that Beijing was making substantial inroads through infrastructure and energy in Latin America, noting the region hosted Beijing’s “largest space infrastructure footprint outside of mainland China.” One such place is a space observation center in Argentina’s Patagonia region that occupies an area roughly half the size of New York’s Central Park, which US officials have long speculated is used for tracking American military satellites.

ADVERTISEMENT:

CONTINUE READING BELOW

Venezuela will provide the first test of how China’s interests are handled. In the wake of Maduro’s ouster, China’s top financial regulator asked its policy banks and other major lenders to report their lending exposure to Venezuela, people familiar with the matter said earlier this week.

China became a key lender to Venezuela in 2007, when it first provided funds for infrastructure and oil projects under late President Hugo Chavez. Estimates suggest that Beijing lent upwards of $60 billion in oil-backed loans through state-run banks until 2015.

China has sought to reduce its exposure over the past decade, with imports from Venezuela last year on pace to shrivel to just 8% of purchases it made 13 years ago. Caracas is still on the hook to repay about $20 billion to China, including arrears accumulated in recent years, according to Stephen Kaplan, associate professor at George Washington University’s Elliot School of International Affairs and author of the book Globalizing Patient Capital: The Political Economy of Chinese Finance in the Americas.

China National Petroleum Corporation, one of China’s largest state-owned oil and gas majors, currently has the biggest presence in Venezuela. Leading Chinese oil companies with interests in the country this week asked officials in Beijing for guidance on how to protect their investments, in an effort to align their responses with China’s diplomatic strategy and salvage existing claims to some of the world’s largest oil reserves, Bloomberg reported.

China has invested billions in hydrodams, wind and solar farms and gas and coal generators in Latin America. In Ecuador, for instance, Beijing has helped finance about 2.3 gigawatts of hydropower, more than a quarter of the country’s entire generation capacity, according to data from Boston University and BloombergNEF.

A sign shows Hugo Chavez shaking hands with Hu Jintao at the entrance to China Railway Engineering Corp.’s Tinaco-Anaco railway project site in Los Dos, Venezuela in 2012. Photographer: Meridith Kohut/Bloomberg

The place where China’s electricity investments are most prevalent is Brazil, where Beijing has helped finance more than 21 gigawatts of capacity mostly in hydropower projects — roughly 7% of the country’s generation capacity. China’s State Grid Corp. has won billions of dollars worth of transmission line projects, and built a 2,500-kilometer (1,550-mile) ultra-high voltage power line — the longest in the world outside China — through the Brazilian rainforest connecting the Belo Monte dam to Rio de Janeiro.

Most notably, Envision Energy, a major wind turbine manufacturer, will develop Latin America’s first Net-Zero Industrial Park in Brazil, focusing on sustainable aviation fuel, green hydrogen and ammonia. EV giant BYD Co also opened the $1-billion Camaçari plant, its largest facility outside Asia in Brazil.

State-owned agribusiness Cofco International Ltd. expanded its agricultural presence in Brazil — the world’s top soybean exporter — by constructing one of its largest overseas export terminals at the Port of Santos. The facility, estimated to ship 8 million tons of commodities a year including soybeans, corn and sugar, underscores Beijing’s strategy of investing in critical links in the agricultural supply chain rather than merely buying commodities on the open market.

“Until now, the ‘Donroe Doctrine’ was mostly rhetorical,” said Jeremy Chan, a former US diplomat who is now a senior analyst at Eurasia Group. “After this weekend’s events, Beijing has to be reconsidering its ability to hold onto its investments across the region.”

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Trump #opens #front #China #brazen #arrest #Maduro