African credit markets may disappoint investors hoping for a repeat of last year’s stellar returns, according to hedge fund Enko Capital Management LLP, which is seeking out trades to cushion against setbacks in the continent’s top performing assets.

The key risk for Africa is a reversal of the dollar weakness seen in 2026, and the possibility that central banks including the Federal Reserve are done cutting interest rates, said Alain Nkontchou, the chief investment officer at Enko, a $1.4 billion firm that manages debt and equity investments across Africa, including private credit funds.

“We think 2026 could be quite different to 2025,” Nkontchou said in an interview. While dollar-denominated bonds from African nations led last year’s bumper returns in frontier debt, he links the gains primarily to the dollar’s 8% slide, which may not continue in 2026.

“Everyone wants to view the dollar weakness as something structural,” Nkontchou said. “If easy monetary policy is over, which might be the case in developed markets, you would not expect the kind of outperformance there has been on hard currencies in frontier markets in Africa.”

Enko handed investors a 32% return in the first 11 months of 2025, triple the average 11% gain posted in the same period by emerging debt-focused hedge funds, data compiled by Bloomberg show. It was set to be the best year for the fund since its inception in 2016, raising its average annual return to 17.2%.

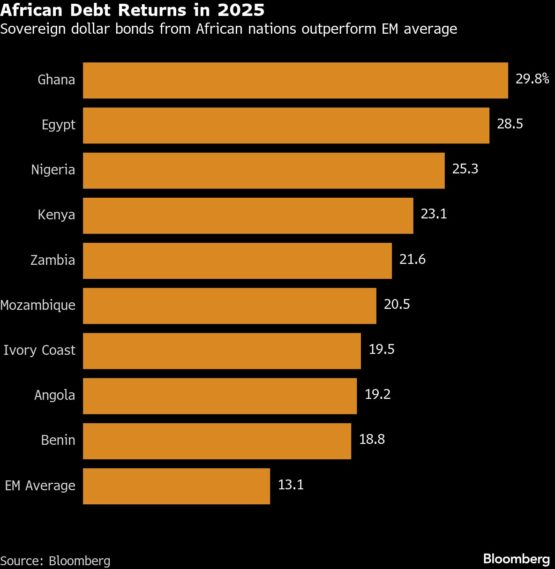

The gains came amid a banner year for emerging debt, where half of the sector’s top 10 performers were African. Sovereign dollar bonds from Ghana, Egypt, Nigeria, Kenya and Zambia returned more than 20%, data compiled by Bloomberg show, while in local bond markets, Nigeria and South Africa notched returns of about 40%.

ADVERTISEMENT

CONTINUE READING BELOW

In a letter sent to clients in December, Enko said November returns were led by hard currency debt in sub-Saharan Africa, followed by African local-currency sovereign debt.

Investors’ optimism on Africa stems also from improving economic prospects and a reduced likelihood of default, as the artificial-intelligence boom lifts metals prices to record highs. Nkontchou says this can continue, yet exorbitantly valued global stocks could be vulnerable to a correction, which would carry repercussions for emerging markets.

Africa’s tight credit spreads make it important to think strategically to see which markets have room to weather market reversals, he said. While declining to elaborate on position changes, he named Egypt, Ghana and Zambia as the credits currently on his investment radar.

Enko is also looking for “cheap hedges in case you have a shock,” though the lack of credit default swaps (CDS) in many African countries can be a problem. CDS are akin to insurance that pays out if a company or country defaults on its debt, but South Africa is one of the few African nations with liquid CDS contracts.

ADVERTISEMENT:

CONTINUE READING BELOW

“That’s the problem. You have to be rather inventive,” Nkontchou said, declining to give details of his hedging strategies.

Still, pockets of distress remain in Africa, with Senegal’s yield spread versus Treasuries standing at over 1,000 basis points, after the discovery of $7 billion in previously undisclosed debt led the International Monetary Fund to suspend a $1.8 billion funding package.

Nkontchou urged Senegal to “have a hard talk with the IMF,” and accept the fiscal constraints that will be required.

According to him, that sort of fiscal uncertainty justifies the extra yield premium investors demand of African governments. The Africa Finance Corp has dubbed it a “prejudice premium,” estimating the continent’s additional annual borrowing costs at $75 billion.

“If you don’t have an environment where the market is convinced that you can actually have a stable macroeconomic picture, they will price a premium,” Nkontchou said. “It’s not just Africa, it’s everywhere.”

© 2026 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.

#Hedge #fund #Enko #flags #Africa #risks #dollarlinked #boom #year